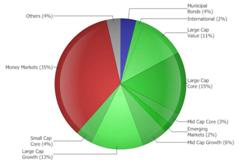

An asset allocation study published in the Financial Analysts Journal in 1991, observed the performance of a number of large pension funds over several years. The results? Asset allocation explained 91.5% of the variation in quarterly total returns among observed pension plans (Gibson, 2000). Investors who don’t account for asset allocation have a giant void in their decision-making process. Vaughn Woods Financial Group has its own proprietary asset allocation program for monitoring every portfolio’s asset allocation relative to one of five different risk allocations. Based on comprehensive research, we dynamically overweight and underweight specific asset classes to best position your portfolio for the different stages of the economic cycle.

January 2026 – Navigating Ray Dalio’s Five Major Risk Forces

Navigating Ray Dalio’s (500 Year) Five Major Risk Forces: Your

December 2025 – A Call to a Year of Radical Honesty

A Call to A Year of Radical Honesty Facing Our