Guns or butter? Inflation or standard of living? Ukrainian cities continue to suffer Russian bombing even as Russian officials are thought to be behind the poisoning of at least two senior Ukrainian peacekeepers prior to the start of new peace talks. Meanwhile, U.S. President Joe Biden announced the largest investment in national security in history, $773 billion for the Department of Defense amid news his entire budget is set at approximately $23 trillion. Biden’s $773 billion in defense spending is equal to approximately half of the Russian GPD for 2022. The U.S. is also sending Germany its most advanced fighter jets, capable of sophisticated air defense maneuvering, including jamming radar. Peace talks may get underway in Turkey this week.

Meanwhile, the institution thought to be the primary source of inflation, the Federal Reserve, has finally begun to raise interest rates as board members have quickly turned universally hawkish. Inflation is very dangerous because it reduces the standard of living of the American people, particularly those retirees living on a fixed income. Inflation outpaces wage increases. Inflation reduces federal spending on healthcare, defense, social security, education, veterans benefits and Medicare. Bottom line: inflation attacks national health and safety.

U.S. inflation is thought to be the result of unprecedented overuse and abuse of monetary and fiscal policies which rely upon an academic economic theory called Modern Monetary Theory. Modern Monetary Theory (MMT) is the “progressive” belief espoused by Bernie Sanders’ economic advisor, Stephanie Kelton, and is based upon the idea that taxes don’t pay for anything. In fact, as the theory goes, the federal government spends first. Then it increases taxes later to get that money back.

But what about Supply Side Economics (SSE) which supports lower taxes? MMT uses increased government spending, debt, and money creation to boost the economy, whereas Supply Side Economics lowers tax rates to motivate more private spending and investments. The insidious nature of MMT is that it ensures future tax hikes.

So, the installation of MMT provides for the assured destruction of SSE, which argues for lower taxes well into the future. However, now as the correlation between MMT and inflation grows, MMT may be on its way out after the mid-term elections. No one really knows the effect of flipping between MMT and SSE, though one could surmise it reduces the efficiency of both models. Both models recognize the deleterious effect of maintaining outrageously large national debts. Moreover, many economists now fear that the opportunity to regain control of inflation by raising rates has passed, and only a recession will bring about the end of an inflationary spiral.

Undoubtedly, the U.S. economy suffers from its highest consumer price inflation rate in 40 years because of MMT policy overuse and abuse of economic juice. Fiscal support equivalent to WWII was supplied to a COVID shutdown economy that largely rebounded within months, though the repercussions of the COVID shutdown are still affecting the supply chain today. Yet, despite the extraordinarily high deficit-to-GDP ratio, many congressional leaders still love MMT to expand fiscal spending.

So, with economic policies in question, war raging, and inflation crushing it, why is the stock market holding up? Here are several reasons:

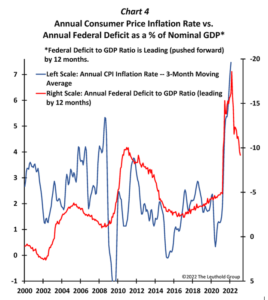

- Surprisingly, fiscal policy has been constrained over the last year given a combination of massive tax receipts from a booming economy coming out of lockdown and the lack of budgetary packages being passed the last several months due to legislative gridlock. During this time the federal deficit declined by more than nine percentage points as a percent of nominal GDP! This ratio has fallen from 18.5% in March 2021 to about 9.2% today.

- Like monetary policy, changes in fiscal growth tend to pressure inflation on a roughly one-year delay. Therefore, expect the belated impact of 9% budgetary tightening (since last March) to help arrest current inflationary trends for the balance of 2022.

- A significant flattening of the yield curve over the last year suggests an improvement in the inflation rate for the coming year. Additionally, the U.S. dollar has also preemptively increased since early 2021. As a result, the trade-weighted U.S. Dollar Index has risen 10% from its lows in April 2021 and is more than 20% higher than the first five years of the last decade. In a similar fashion to monetary and fiscal policies, dollar strength with a lag of around one year often helps moderate the rate of inflation.

- The Fed and the Treasury’s “official actions” have worked slowly in the fight against inflation. Nonetheless, monetary, fiscal, yield-curve, and dollar policies have all been considerably restrictive for the last year and do not appear to be behind the curve!

- Although the Ukrainian situation and massive policy stimulus have certainly influenced the inflationary outcome, the most prominent pressure behind elevated inflation may be the unique supply-restricting impact of the pandemic. This will abate causing many to believe the inflation problem is effectively entrenched.

The following chart (Chart 5) highlights the degree to which the tracks of COVID are still very pronounced and obviously continuing to restrict the supply side of the economy. The level of inventory relative to GDP is reminiscent of a recessionary bottom rather than an expansion entering its third year. Companies have been unable to restock the shelves primarily because of a chronic inability to hire sufficient staff.

Finally, the technical take suggests this market is somewhat bullish going forward suggesting a war resolution may be in the cards within the near future, though this is mere speculation at this point. Nevertheless, the cyclical trend index points to a +12 bullish stance going into April. The sentiment index remains positive. This sentiment index tracks thirteen indicators that measure excessive bullish or bearish conditions prevalent in the market. Conversely, when fear is rampant, a bullish condition exists and with gas prices, inflation and war on people’s minds, the University of Michigan Consumer Sentiment indicator is as low as it has been in decades going back to 1981.

Sincerely

Vaughn Woods, CFP, MBA

Vaughn Woods Financial Group, Inc.

2226 Avenida De La Playa

La Jolla, CA 92037

858-454-6900

www.vaughnwoods.com

Sources:

Leuthold Group, LLC

Investors should be aware that there are risks inherent in all investments such as fluctuations in investment principal. Past performance is not a guarantee of future results. Asset allocation cannot assure a profit nor protect against loss. Although the information has been gathered from sources believed to be reliable, it cannot be guaranteed. Views expressed in this newsletter may not reflect the views of Bolton Global Capital or Bolton Global Asset Management. The information provided is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. VW1/VWA0271.